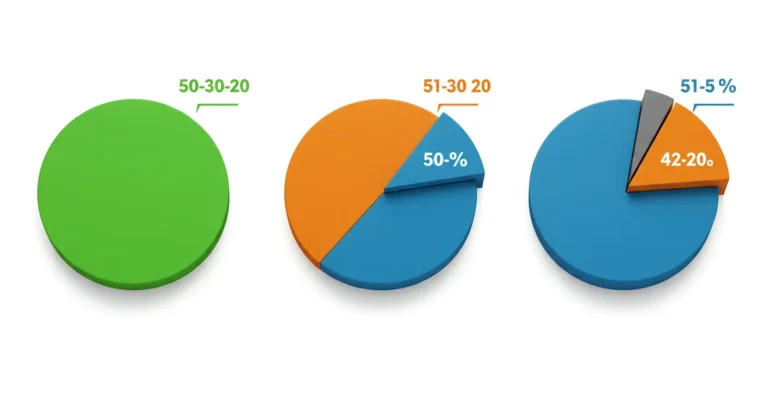

What is the 50 30 20 rule? It’s a straightforward yet powerful budgeting guideline that can transform the way you manage your finances. Picture this: you receive your paycheck, and instead of cringing at how much goes to bills or wondering if you can splurge a little on the latest gadget, there’s a clear path laid out before you. This system, recommended by financial experts, divides your after-tax income into three categories: needs, wants, and savings. It’s all about balance, ensuring you’re not just living paycheck to paycheck but actually building towards your future while enjoying life now.

Developed in the midst of an evolving financial landscape, the 50 30 20 rule serves as a beacon of clarity in personal finance. With rising living costs and a plethora of financial products available, it can feel overwhelming to figure out where your money should go. This rule simplifies that process and makes budgeting accessible for everyone, whether you’re just starting out or looking to refine your savings strategy. The best part? It provides a flexible framework, adapting to various income levels and lifestyles.

You might wonder, “How do I even implement this rule?” Don’t worry! I’ll guide you through practical strategies and tips on how to allocate your income effectively. This method not only promotes financial literacy but also stresses the importance of prioritizing what truly matters to you. By embracing this rule, you can change how you think about money—from a source of stress to a tool for empowerment.

So, whether you’re dreaming of a well-deserved vacation, aiming to boost your savings for a home, or just want to avoid financial anxiety, understanding the 50 30 20 rule can set you on the right track. Let’s dive deeper into each category and see how you can apply this rule in real life.

Understanding the Breakdown: Needs, Wants, Savings

To get the hang of the 50 30 20 rule, we need to unpack what each category means. At first glance, it’s straightforward, but the real magic lies in how you interpret “needs,” “wants,” and “savings.” Let’s break it down further.

Needs: The Essential Items

Needs encompass the non-negotiables in your life. These are the expenses critical for your survival and everyday functioning. Think of essentials like:

- Housing (rent or mortgage)

- Utilities (water, electricity, heating)

- Groceries

- Transportation (car payments, public transit)

- Health insurance

In essence, you should aim to keep these expenses within 50% of your after-tax income. If you find yourself exceeding this, it could be a sign to reassess your expenditures or income.

Wants: The Joyful Indulgences

Moving on to wants: this is where life gets a little fun! Wants are the extras that enhance your lifestyle but aren’t strictly necessary. This can include:

- Dining out or takeout

- Movies or entertainment subscriptions

- Hobbies (sports, music lessons, etc.)

- Vacation expenses

- Technology upgrades (the latest smartphone)

Keeping your wants to 30% of your income helps you enjoy life while being smart about spending. It’s crucial to identify which of these “wants” actually bring you joy versus those that feel more like obligations.

The Power of Savings: Building Your Future

Now, onto the pivotal 20%: your savings. This portion can profoundly impact your financial future, providing security, investment opportunities, and a cushion against surprise expenses.

Emergency Fund: Your Safety Net

A chunk of this savings should go into an emergency fund—typically three to six months’ worth of living expenses. Imagine having that peace of mind, knowing you have a safety net if you lose your job or face an unforeseen expense. The 50 30 20 rule is not just about surviving; it’s about thriving with foresight.

Long-Term Goals: Invest in Yourself

The remaining savings can go towards long-term investments, retirement accounts (like a 401(k) or IRA), or specific savings goals (like buying a home). This allocation isn’t just about being responsible; it’s about ensuring that the future you dream of is achievable.

Practical Implementation of the 50 30 20 Rule

So, how do you bring this rule from theory into practice? Implementing the 50 30 20 rule can feel daunting at first, but with some simple steps, you can make it work for you.

Create a Budget

The first step is setting up a budget based on your income. You can use budgeting apps, spreadsheets, or good old-fashioned pen and paper—whatever works best for you! Track your monthly income and categorize your expenses to see where your money goes.

Adjust as Needed

Life isn’t static; it’s dynamic! If you find you’re spending too much in one category, assess why that is. Are there subscriptions you’re not using? Is your grocery budget inflated? Getting granular with your expenses ensures you stay within the 50 30 20 framework more naturally.

Common Challenges and Solutions

Implementing the 50 30 20 rule is not without its challenges. Here are a few common stumbling blocks I’ve seen, along with solutions.

Unforeseen Expenses

Life is unpredictable, and sometimes you face expenses that throw off your budgeting. Set aside a small portion of your needs category for the unexpected. This will allow you to maintain balance without feeling overwhelmed.

Impulse Spending

We’ve all been there. You see a new gadget, and suddenly your wants deviation is shot! Combatting impulse spending can be as simple as adopting a waiting period—give yourself a day or two before making non-essential purchases. You might find you don’t want it as much after that time.

Useful links

Conclusion

In wrapping up our exploration of the 50 30 20 rule, it’s clear that this straightforward budgeting method can revolutionize how we handle our finances. Whether you’re saving for a dream vacation, planning to buy a home, or simply aiming to gain better control over your expenses, this rule can be your guiding light. It elegantly breaks down your income into three categories: needs, wants, and savings, making budgeting feel less daunting and more achievable.

Imagine waking up each day knowing exactly how much you can spend without guilt or anxiety. It’s a liberating feeling, right? The beauty of the 50 30 20 rule is its flexibility. Life can throw unexpected expenses our way, but adjusting these percentages slightly—maybe spending a little more on a crucial need or a deserving want—can keep you on track while still enjoying life’s pleasures.

Ultimately, adopting the 50 30 20 rule means committing to a healthier financial lifestyle that allows space for both responsibility and enjoyment. So, whether you’re a budgeting novice or a finance whiz, give this rule a try and see how it transforms your relationship with money. You might just find that managing your finances doesn’t have to be a chore; it can be a rewarding path to financial freedom!

Frequently Asked Questions

What exactly is the 50 30 20 rule?

The 50 30 20 rule is a simple budgeting framework that divides your after-tax income into three main categories: 50% for needs (essential expenses like housing and groceries), 30% for wants (discretionary spending such as dining out and entertainment), and 20% for savings and debt repayment. This method helps individuals manage their finances more effectively without feeling deprived, as it allows for a balanced approach to essential spending and personal enjoyment.

Can the percentages be adjusted?

Absolutely! While the 50 30 20 structure provides a solid foundation, it’s not a one-size-fits-all solution. Depending on your financial situation or goals, you might choose to allocate more toward savings, especially if you’re planning for significant expenses like a home purchase or retirement. Flexibility is key; therefore, feel free to adjust the percentages to reflect your unique lifestyle and ambitions.

What constitutes a ‘need’ versus a ‘want’?

Determining needs versus wants can sometimes be subjective. Generally, ‘needs’ are essential for daily living and safety, such as rent, utilities, groceries, and healthcare. ‘Wants,’ on the other hand, are non-essential items that enhance your quality of life, like dining out, vacations, or subscription services. Creating clear distinctions can help you prioritize smartly while budgeting.

How does the 50 30 20 rule help with debt management?

If applied diligently, the 50 30 20 rule can significantly aid in managing debt. The 20% savings portion can be utilized to pay off existing debt, such as credit cards or student loans, helping you reduce interest payments over time. By treating savings and debt repayment as equal priorities, you’re not only building your financial future but also alleviating the burdens of debt.

Is the 50 30 20 rule applicable to irregular income?

Yes, the 50 30 20 rule can certainly work for those with irregular incomes, like freelancers or commission-based workers. Instead of strictly applying it to monthly income, consider averaging your income over several months to establish a baseline. You can then utilize the rule within that average, adjusting categories based on fluctuating income levels. This approach helps maintain financial stability even when income is unpredictable.

What if I can’t stick to the 50 30 20 rule?

Sticking to the 50 30 20 rule can be challenging at times, particularly if unexpected expenses arise. If you find it difficult to adhere strictly, don’t be too hard on yourself. Consider keeping a closer eye on your spending for a month or find ways to cut costs in categories where you’re overspending. Small adjustments and regular reviews of your budget can lead to improvements over time without the pressure of absolute perfection.

Are there specific tools to help implement the 50 30 20 rule?

Yes! There are numerous budgeting apps and tools available that can assist in implementing the 50 30 20 rule. Popular apps like Mint, You Need a Budget (YNAB), and PocketGuard offer features to categorize your spending automatically and help track your progress toward each percentage goal. Utilizing technology can make budgeting less cumbersome and more enjoyable, making it easier to embrace the method in your everyday life.