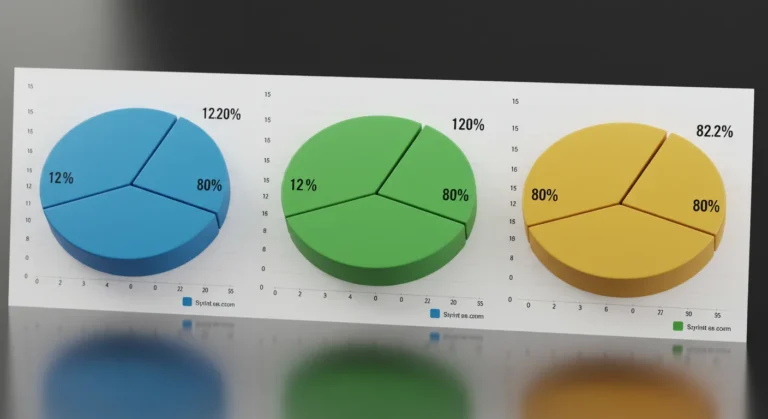

What is the 12 20 80 asset allocation rule? You might be wondering if this numeric formula can really make a difference in your financial future. The 12 20 80 rule simplifies asset management and aims to maximize your investment returns while minimizing risk through a strategic distribution of funds across different asset classes. By breaking your investments into manageable sections, this rule not only enhances your overall portfolio performance but also instills a sense of financial discipline. If you’re feeling overwhelmed by the complexities of investing, this rule could be a game-changing approach for you.

The beauty of the 12 20 80 asset allocation rule lies in its straightforwardness. It suggests that you allocate 12% of your investments to cash, 20% to bonds, and a whopping 80% to stocks. Sounds intriguing, right? But why exactly should we consider this allocation model? This is not just a random distribution; each percentage represents an investment philosophy aimed at balancing growth and security effectively. By the end of this article, you’ll understand not only how to implement this rule but also the logic behind these particular percentages.

Imagine you’re on a financial journey; this rule serves as your map, helping you navigate through various asset types. Using a combination of cash, bonds, and a generous proportion of stocks helps in creating a well-rounded portfolio. Are you tired of not knowing where to put your money? This allocation method might be just what you need to break out of the confusion and start building wealth.

Let’s dive into how to implement the 12 20 80 asset allocation rule and explore its implications for your investments. With just a few simple steps, you can refine your portfolio strategy and enhance your financial literacy. So, buckle up, and let’s explore this fascinating model together!

Understanding the Basics of Asset Allocation

Before we dive deeper, let’s make sure we’re on the same page regarding asset allocation. In essence, it’s the process of distributing your investments across various asset categories to manage risk and optimize returns. Given this fundamental premise, the 12 20 80 rule stands out as a practical and systematic approach to achieving financial equilibrium.

Why Asset Allocation Matters

Think of your investment portfolio as a delicious meal. Would you serve only one dish? Absolutely not! A well-balanced plate should consist of multiple flavors and textures. Similarly, a solid asset allocation helps mitigate risks while giving you exposure to potential high-reward investments. Additionally, diversifying your assets allows you to weather market fluctuations with a bit more grace.

The Breakdown of the 12 20 80 Rule

Now, let’s delve into the specifics of each segment of the 12 20 80 rule. This breakdown will empower you with greater insight into the rationale behind these allocations. You can think of each percentage as stepping stones along your path to financial success.

12% in Cash

The 12% allocation to cash acts as your safety net. This portion could be placed in savings accounts, money market accounts, or short-term Treasury bills. The idea here is to ensure liquidity and provide immediate access to funds when needed. Why is this crucial? Life is unpredictable, and with cash on hand, you’re less likely to panic during market downturns or emergencies.

20% in Bonds

The next 20% allocation is directed toward bonds. Bonds can be a fantastic way to generate steady income while offsetting the volatility that comes with stocks. Think of them as the reliable friend who’s always there to catch you. By including bonds in your investment strategy, you reduce overall risk and help stabilize your portfolio against stock market fluctuations.

An 80% Stock Allocation

Now, we come to the lion’s share of the allocation: 80% in stocks. This brave allocation seeks to capitalize on potential high returns offered by equities. Are you excited? You should be! Stocks have historically performed well over the long term, outpacing inflation and providing opportunities for wealth-building. However, this means you need to brace yourself for possible short-term swings, so always have a strategy in place.

Real-World Application of the 12 20 80 Rule

Implementing the 12 20 80 rule can feel daunting at first, but let’s take a look at a practical scenario that illustrates how you might flesh it out in real life. Picture yourself as Alex, a 30-year-old professional looking to secure your financial future.

Meet Alex

Alex just landed a new job with a stable income. After getting his finances in order, he decides to allocate his $30,000 investment according to the 12 20 80 rule. With this allocation:

- 12% in Cash: $3,600 in a high-yield savings account for emergencies and short-term needs.

- 20% in Bonds: $6,000 invested in a diversified bond fund that includes government and corporate bonds.

- 80% in Stocks: $24,000 split between a mix of domestic and international stock funds along with some individual stocks.

With this structure, Alex positions himself for growth while ensuring that he has both liquid cash and stable bonds backing him up in these volatile times.

Challenges to Consider

Every investment strategy has its hurdles, and the 12 20 80 asset allocation rule is no exception. One potential challenge is the fluctuating market conditions, which may necessitate adjustments to your allocations. Are you feeling anxious about making changes? It’s normal! The key is to remain flexible while adhering to the core principles of the rule.

The Risk of Over-Reaction

Market timing is a daunting beast. The risk of adjusting your portfolio based on fear during market downturns could lead to disastrous long-term consequences. Stick to your allocations as much as possible, and remember to review your strategy regularly without succumbing to short-term panic.

Final Thoughts on Your Financial Journey

The 12 20 80 asset allocation rule is not just some obscure financial jargon; it’s a beacon guiding you toward a sound investment strategy. By dividing your assets sensibly across cash, bonds, and stocks, you’re not just throwing darts in the dark but rather strategically placing your bets to maximize returns while mitigating risk.

Now that you have a comprehensive understanding of the rule and its applications, I invite you to take the reins of your financial future. Whether you’re just starting or looking to refine your existing strategy, the 12 20 80 rule can serve as a valuable framework. Let’s optimize your investment portfolio and pave the way for a prosperous future!

Useful links

Conclusion

As we wrap up our exploration of the 12 20 80 asset allocation rule, it becomes clear that this strategy offers a balanced approach to portfolio management. By dividing your investments into manageable segments, we can alleviate some of the anxiety that comes with financial planning. It’s a simple yet powerful method, perfect for anyone who’s seeking a straightforward way to optimize their asset mix without becoming overwhelmed.

Embracing this rule doesn’t mean you have to stick rigidly to percentages; rather, consider this a starting point. You might find you enjoy the thrill of actively rebalancing based on market conditions or personal goals. The 12 20 80 rule is more than just numbers; it’s about creating a sense of security in an uncertain world. The peace of mind that comes from knowing you have a strategic roadmap can be invaluable in times of volatility.

So, whether you’re just beginning your investing journey or looking to refine an existing portfolio, remember that the 12 20 80 asset allocation rule opens doors to thoughtful investment decisions. It encourages us to take control of our financial futures, helping us work towards our dreams, one wise investment at a time.

Frequently Asked Questions

What does the 12 20 80 asset allocation rule mean?

The 12 20 80 asset allocation rule suggests that an investor should allocate their portfolio in three distinct segments: 12% in stocks of large companies, 20% in mid-sized companies, and 80% in cash or cash equivalents. This approach aims to balance the risk associated with stock investments while giving you a cushion of liquid assets. By following this guideline, you can potentially achieve steady growth while maintaining a safety net for financial uncertainties.

Is the 12 20 80 rule suitable for beginners?

Absolutely! The 12 20 80 rule is particularly friendly for beginners because it simplifies the complex world of investing into easy-to-follow guidelines. For someone just starting out, having a clear, logical framework can be incredibly helpful. It allows you to focus on your investment journey without feeling daunted by overwhelming choices, providing a great foundation to build upon as your experience grows.

How often should I rebalance my portfolio under this rule?

While the 12 20 80 rule gives you a structured approach, the frequency of rebalancing depends on your personal investment strategy and market conditions. Generally, a good practice is to review your portfolio at least annually to check if your asset allocation aligns with your goals. If one of your segments shifts significantly—say, due to market fluctuations or personal circumstances—it might be wise to rebalance even sooner to keep your allocations in check.

Can I adjust the percentages in the 12 20 80 rule?

Yes, you can definitely tweak the percentages of the 12 20 80 rule to better suit your risk tolerance, investment goals, and market outlook. Some investors might prefer to allocate a higher percentage to equities for greater growth potential, while others might lean toward a more conservative mix. The key is to maintain a diversified portfolio that reflects your individual circumstances, which keeps you comfortable during market ups and downs.

Why is cash allocation so high in the 12 20 80 rule?

The higher allocation to cash in the 12 20 80 rule serves multiple purposes. It provides a buffer against market volatility and acts as a financial safety net during economic downturns. Cash can also enable you to pounce on investment opportunities quickly without the need to liquidate other assets. This liquidity aspect is vital, especially for those who may require immediate access to funds for emergencies or sudden expenses.

What kinds of assets should I consider for each category?

For the 12% stocks allocation, consider large-cap companies like those in the S&P 500, which often offer stability and reliability. The 20% mid-sized companies might focus on growth-oriented stocks that can provide increased returns but come with added risk. Cash allocations could go in high-yield savings accounts, money market funds, or short-term bonds, all of which keep your capital safe while still generating some returns. Diversifying within each category can enhance your portfolio’s overall performance.

How do I know if the 12 20 80 rule is working for me?

You can gauge whether the 12 20 80 rule is effective for your investment strategy by monitoring your portfolio’s performance against your financial goals over time. Track your returns and compare them with market benchmarks to evaluate success. Additionally, assess whether your investment strategy provides you with the peace of mind and financial security you desire. If you feel comfortable and satisfied with your financial progress, it’s a good sign that this rule is working well for you.