What is the 50/30/20 rule of money? At first glance, this might sound like a complicated financial strategy or just another budgeting trend circulating on social media. However, it presents a simple yet powerful framework for managing your finances that can radically shift your approach to spending and saving. Developed by U.S. Senator Elizabeth Warren, this budgeting rule breaks down how to allocate your income in a way that balances essential needs, discretionary wants, and savings to comfortably secure your financial future. But why is it relevant today? In a world overwhelmed by debt and financial anxiety, understanding and applying this rule can help you not only survive but thrive financially.

The allure of the 50/30/20 rule lies in its simplicity. It categorizes your income into three distinct areas: needs, wants, and savings. By adhering to this straightforward formula, anyone—from fresh graduates starting their careers to seasoned professionals—can develop a sustainable budgeting plan that mitigates financial stress while promoting growth. Perhaps you’re wondering, “How do these percentages translate into real-life scenarios?” Or maybe you’re asking, “Will this really work for someone in my situation?” Trust me, I’ve got your back as we explore the nitty-gritty of this handy financial strategy!

Armed with this knowledge, you’re on your way to gaining financial insights that can change how you approach monthly expenses and savings. It’s not about sacrificing fun in life but about finding balance—a necessity in today’s consumer-driven world. So, let’s dig into the details and see how the 50/30/20 rule can change your financial trajectory for the better.

Are you ready to understand how to transform your financial landscape? Grab a cup of coffee, and let’s dissect this budgeting genius together!

The Breakdown of the 50/30/20 Rule

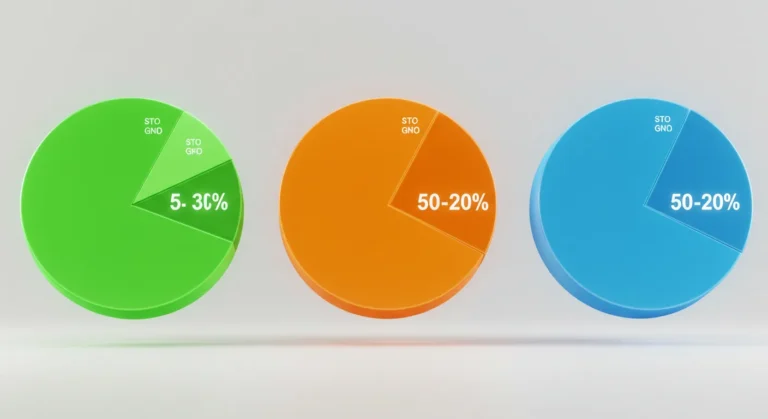

Let’s start with defining those percentages! The 50/30/20 rule dictates that you allocate your after-tax income as follows:

- 50% for Needs: This includes essentials like housing, food, healthcare, and utilities.

- 30% for Wants: Here, you cover your desires—dining out, vacations, and entertainment.

- 20% for Savings and Debt Repayment: This portion is critical for building an emergency fund, retirement savings, or making extra payments on any existing debt.

This structured approach helps you visualize where your money goes and ensures you prioritize what truly matters. It’s like having a financial GPS guiding you through your spending journey!

Understanding the ‘Needs’

Needs are non-negotiable. Think about it: shelter and food are fundamental for survival, right? Under this category, you might find yourself budgeting for rent or mortgage payments and basic groceries. What’s important is to distinguish these needs from wants.

For instance, while you must eat, choosing to purchase organic produce over conventional might be a want rather than a need. Get clear about what essentials truly are, and you’ll be better equipped to stay within that vital 50% threshold.

Managing the ‘Wants’

Next up is the fun part—wants! This is your chance to reward yourself, but beware: it can be a slippery slope. It encompasses anything that enhances your quality of life but isn’t strictly essential.

Consider setting personal rules around your wants, like designating a specific amount for entertainment or dining out. This way, you indulge guilt-free, knowing you’re sticking to your budget.

Breaking Down the Savings

Now, let’s talk savings! Allocating 20% of your income to savings and debt repayment isn’t just a recommendation; it’s a lifeline. Without savings, you risk falling into a debt cycle where you rely on credit for emergencies.

Building an Emergency Fund

Your first task should be building an emergency fund. Aim for three to six months’ worth of living expenses so that you’re prepared for unforeseen circumstances like job loss or medical emergencies.

Imagine losing your job unexpectedly. With an emergency fund, you wouldn’t have to stress about covering bills until you find another position.

Investing for the Future

Once your emergency fund is secure, consider investments. Whether it’s through retirement accounts like 401(k)s or IRAs or other avenues, the goal is to grow your money over time. The earlier you start investing, the more benefits you’ll reap from compounding interest!

Practical Challenges and Solutions

Living by the 50/30/20 rule sounds great in theory, but how do you make it work in practice? Life has a sneaky habit of throwing curveballs, and sometimes sticking to these percentages can feel nearly impossible.

Adjusting Percentages When Needed

If you find that 30% of your income isn’t enough to cover your wants due to high living costs, it’s okay to make temporary adjustments. Just be mindful of not exceeding your paychecks in needs!

Tracking Spending

Keeping accurate records of your expenses can be a game-changer. Try using budgeting apps or simply a spreadsheet where you log what you spend each month. Doing so will help you visualize where adjustments can be made and help reinforce your financial goals.

The Emotional Aspect of Money Management

Budgeting can often feel like a numbers game, but it’s important to recognize the emotional elements tied to money. We all have a unique relationship with finances shaped by upbringing and personal experiences.

Understanding Your Money Mindset

Your money mindset influences how you interact with the 50/30/20 rule. Are you optimistic about saving, or do you feel overwhelmed? Identifying your feelings towards spending and saving can help you reframe your approach and cultivate and healthier relationship with money.

Celebrating Small Wins

Finally, it’s crucial to celebrate your milestones, no matter how small! Achieving a savings goal or sticking to your budget for a month? Acknowledge your hard work and treat yourself (within that 30%!).

Adventure awaits! By mastering the 50/30/20 budgeting rule, you’re not just managing your finances; you’re embracing a lifestyle of financial empowerment that can help pave the way to your dreams. I hope this guide serves as the sturdy roadmap you need for your financial journey. Whether you’re just getting started or looking to fine-tune your planning, the 50/30/20 principle equips you with the tools to lead a balanced and fulfilling financial life. Remember, the key to financial freedom is consistent action—you’ve got this!

Useful links

Conclusion

So, there you have it! The 50/30/20 rule is not merely a budgeting strategy; it’s a roadmap to financial freedom. By allocating your income into these simple categories, you empower yourself to make mindful financial choices. Think of it as a way to establish a healthy balance between enjoying life’s pleasures and securing your future. Isn’t it liberating to know that you can splurge a little and still plan for tomorrow?

As we navigate our financial journeys, the importance of flexibility can’t be overstated. Life’s surprises can sometimes toss us off our carefully laid plans. The beauty of the 50/30/20 rule is its adaptability; you can shuffle priorities as your life circumstances change. I encourage you to get comfortable with this budgeting approach and tweak it as necessary. Your financial landscape is unique to you, after all!

So, what are you waiting for? Whether you’re hoping to save for a home, travel, or simply achieve peace of mind regarding your finances, starting with the 50/30/20 rule can set you on the right path. Let’s take control of our wallets and dreams, one smart decision at a time. Remember, it’s not just about saving money; it’s about building the lifestyle you want while ensuring you’re prepared for whatever comes next.

Frequently Asked Questions

What does the 50/30/20 rule really mean?

The 50/30/20 rule is a budgeting framework designed to help individuals manage their finances effectively. It recommends that 50% of your after-tax income be allocated to needs, such as housing and food; 30% go towards wants, like dining out or entertainment; and 20% be dedicated to savings and debt repayment. This simplification allows you to quickly understand where your money should go, ultimately guiding you towards financial health without feeling deprived.

Can I modify the percentages of the 50/30/20 rule?

Absolutely! While the 50/30/20 rule provides a guideline, it’s essential to tailor the percentages to fit your unique financial situation. For instance, if you live in an area with a high cost of living, you may need to allocate more than 50% to needs. Conversely, if you’re aggressively saving for a goal, you might skew towards putting more than 20% into savings. Adjusting these figures allows you to create a budget that aligns with your financial objectives and lifestyle choices.

Is the 50/30/20 rule suitable for everyone?

The straightforward nature of the 50/30/20 rule makes it appealing to many, but it may not be a perfect fit for everyone. For example, those with irregular incomes, significant debts, or unique financial situations might need a more customized approach. If you find yourself struggling to categorize spending into “needs” and “wants,” it may be beneficial to explore other budgeting strategies or consult a financial advisor for personalized guidance.

How can I track my spending under the 50/30/20 rule?

Tracking your spending can be simplified with various tools available today, from budgeting apps to spreadsheets. One effective method is to record your expenses regularly and categorize them according to the 50/30/20 structure. Apps like Mint or YNAB (You Need a Budget) can automatically sort your transactions, making it easier to see how well you’re adhering to your budget. Regular check-ins help you stay accountable and allow for adjustments when needed.

What are some examples of “needs” in the 50/30/20 rule?

In the context of the 50/30/20 rule, “needs” are the essentials that contribute to your basic living conditions. This includes rent or mortgage payments, utilities, groceries, transportation costs, healthcare, and insurance. If these costs exceed 50% of your income due to circumstances like housing market trends, it’s crucial to reevaluate your budget and explore options like finding a more affordable living situation or seeking financial assistance programs.

How should I prioritize saving under this rule?

When saving under the 50/30/20 rule, it’s vital to first identify your financial goals. You might want to build an emergency fund, save for retirement, or tackle debt. Prioritize the 20% savings allocation based on urgency; for example, aim to have 3-6 months’ worth of expenses saved for emergencies. Any increase in income should be considered for boosting your savings contributions, always aligning with your long-term objectives while ensuring you enjoy life’s moments.

Can the 50/30/20 rule help with debt management?

Yes, the 50/30/20 rule can be an effective tool for managing debt. The 20% allocation for savings can also be used for debt repayments. Prioritizing high-interest debt first, like credit cards, and ensuring you’ve set aside the appropriate percentage towards this goal can lead to quicker debt freedom. By being disciplined with your budget and understanding where to funnel those repayments, you can pave the way to a more secure financial future while also improving your overall credit health.