What is the 60/20/20 rule? This intriguing breakdown of budgeting has gained momentum in the personal finance world, and for good reason. Essentially, it proposes a framework for managing your income effectively by allocating specific percentages toward three key areas: essentials, savings, and discretionary spending. Imagine having a clear strategy that not only allows you to enjoy life today but also secures your financial future. That’s what the 60/20/20 rule aims to achieve.

In a world where financial literacy is more critical than ever, many of us find ourselves overwhelmed with choices, making it easy to drift away from our financial goals. The 60/20/20 rule demystifies this process, providing an easy-to-follow roadmap. You may be wondering how you can practically apply this rule in your life—don’t worry, I’ve got you covered! This article will walk you through the nuances of this rule, exploring its origins, its practical applications, and how you can adapt it to fit your financial situation.

The beauty of the 60/20/20 rule lies in its simplicity. It offers an easily digestible guideline to help you balance your immediate needs with long-term goals. Whether you are saving for a vacation, a new home, or retirement, this rule can help you prioritize effectively. So let’s dive deeper into its core components!

Arming yourself with knowledge about the 60/20/20 rule elevates your financial game. Not only will we break down how each percentage functions in your life, but we will also explore actionable steps to take control of your finances. Let’s embark on this journey to financial clarity together.

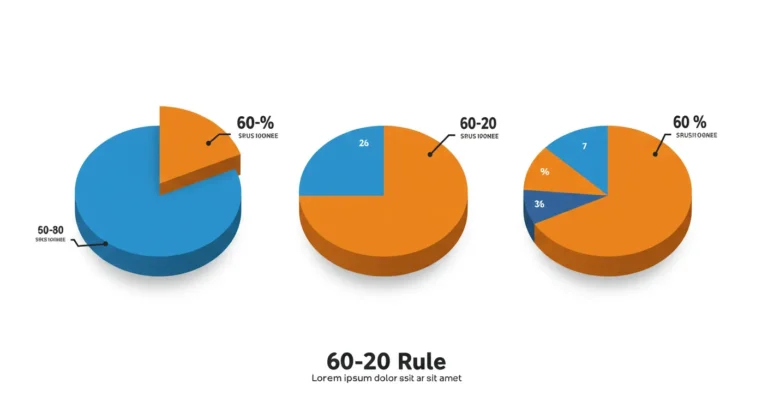

The Breakdown of the 60/20/20 Rule

Understanding what each percentage represents is essential for successfully implementing the 60/20/20 rule. Here’s a closer look at each component and what it entails.

60% for Necessities

The first portion of the 60/20/20 rule allocates a vital 60% of your income to necessities. This includes all your essential living expenses, such as:

- Housing costs (rent/mortgage)

- Utilities (electricity, water, gas)

- Groceries and household essentials

- Transportation (fuel, public transport)

- Insurance (health, auto, home)

Think of this category as your financial foundation. By dedicating a significant portion of your income here, you ensure that your basic needs are met without sacrificing your ability to save or spend on personal enjoyment. You might find it helpful to track these expenses monthly to determine whether you’re consistently staying within this threshold.

20% for Savings

Next comes the critical 20% reserved for savings. This is where the magic happens—setting money aside for future use. This percentage can cover various savings goals, including:

- Emergency fund (3-6 months of living expenses)

- Retirement savings (401(k), IRA)

- Down payment for a home

- Investments in stocks or mutual funds

The act of saving can feel burdensome, but it’s crucial for financial independence. I encourage you to set up automatic transfers to your savings and investment accounts as soon as you receive your paycheck—this way, you make saving a priority rather than an afterthought.

20% for Discretionary Spending

Finally, the remaining 20% of your income can be devoted to discretionary spending. This is your chance to enjoy the fruits of your labor without guilt. Prioritizing this spending allows you to indulge in some fun while maintaining balance. Consider allocating this percentage towards:

- Dining out and entertainment

- Travel and vacations

- Hobbies and personal development

- Gifts and charitable donations

It’s important to approach discretionary spending wisely. By sticking to this budget, you can enjoy life today while still positioning yourself for a secure tomorrow. You might even find that having a set amount to splurge on helps you make more intentional choices about what you truly value.

Adapting the 60/20/20 Rule to Your Lifestyle

While the 60/20/20 rule provides a solid starting point, personal finance isn’t one-size-fits-all. You may need to modify the percentages based on your unique situation. Let’s explore how you can do that effectively.

Customizing Your Percentages

If you find that your essentials take up a larger portion of your income, you might decide to allocate 70% for necessities and split the remaining 30% between savings and discretionary spending. Alternatively, if you are in a phase of life focused heavily on saving, raising that percentage to 30% could work. Flexibility is key!

Identifying Your Financial Goals

Your personal financial goals will shape how you adapt the rule. For instance, if you have significant debt, you might prioritize higher savings over discretionary spending temporarily. Each person’s situation is different, and a proactive approach can help you meet your specific goals. Using a financial planner or budgeting app might also guide you through this customization process.

Combining with Other Budgeting Methods

The 60/20/20 rule isn’t the only approach available for managing your finances. You can also combine it with methods like the zero-based budget or the 50/30/20 rule. Experiment with different methods to find the mix that best supports your financial health and aligns with your values.

Common Misconceptions About the 60/20/20 Rule

Even as the 60/20/20 rule grows in popularity, several misconceptions can hinder its effectiveness. Here are a few to address so you can leverage this rule optimally.

It’s Only for High Income Earners

A common myth is that the 60/20/20 rule is only applicable to high-income earners. The truth is, individuals with any income level can adopt the principles of the rule! Even if your income is low, adopting healthy budgeting practices is more important than the amount you earn. You can adjust the percentages based on your financial situation.

It Doesn’t Allow for Flexibility

Another misconception is that the 60/20/20 rule is rigid and leaves no room for adjustments. Financial circumstances can fluctuate due to unexpected events or changes in goals. Embrace this rule as a guideline rather than a strict formula. Regularly revisit and revise your budget based on life’s evolving demands.

All Savings Are Created Equal

Saving doesn’t just mean stashing cash in a savings account! Some savings can generate returns, such as investing in stocks or a retirement account. Therefore, it’s crucial to differentiate between simply saving money and making that money work for you through smart investing strategies.

Real-Life Scenarios: Success with the 60/20/20 Rule

Let’s look at two hypothetical characters and see how applying the 60/20/20 rule has transformed their financial lives.

Mark: The Aspiring Homeowner

Mark, a 30-year-old teacher, struggled for years with poor financial habits. He decided to adopt the 60/20/20 rule to save for a home. By diligently tracking his expenses, Mark found he could allocate 65% for necessities, including modest rent, utilities, and food. The additional 15% went into savings—coloring his financial life with purpose. Within three years, he built an impressive down payment on a small house!

Emily: The Frequent Traveler

Emily, a 28-year-old marketing professional, wanted to travel while improving her savings. She initially set aside 15% for discretionary spending but found hard it was to resist the siren call of spontaneous trips. By customizing her budget to 50% for necessities, 30% for savings, and a playful 20% for her travel fund, Emily didn’t just save for future adventures; she went on spontaneous weekend getaways without feeling guilty!

Useful links

Conclusion

As we wrap up our exploration of the 60/20/20 rule, it’s clear that this approach to budgeting can be a game-changer in our financial lives. By allocating 60% of our income to needs, 20% to savings, and 20% to wants, we’re not just managing our finances; we’re actively shaping our futures. This balance encourages us to prioritize what truly matters while allowing for enjoyment and security in our financial journeys.

Adopting the 60/20/20 rule can feel empowering. It offers a structured way to handle our resources without feeling confined by rigid arrays of restrictions. I’ve seen how these allocations can help create breathing room for both necessary expenses and pleasurable purchases, underscoring the value of mindful spending. It’s great to realize that we can celebrate our successes and indulge in the things we love without guilt.

Ultimately, whether you’re battling debt, saving for a goal, or simply trying to spend wisely, the 60/20/20 rule is a flexible framework that encourages both responsibility and enjoyment. Why not give it a try? You might find that it not only reshapes how you view your finances but also inspires you to take control, one budget at a time.

Frequently Asked Questions

What does the 60/20/20 rule entail?

The 60/20/20 rule is a budgeting strategy that proposes dividing your income into three distinct categories. Sixty percent is allocated to your basic needs—essential expenses like housing, food, transportation, and utilities. Twenty percent goes towards savings and debt repayment, ensuring you have a financial cushion or are working towards financial freedom. The final twenty percent can be spent on wants or discretionary items. This balanced approach helps manage immediate needs while also nurturing future goals and pleasures.

How can I start implementing the 60/20/20 rule?

To get started with the 60/20/20 rule, first, assess your total income. Next, categorize your current expenses to identify your needs versus wants. This might require some honesty about your lifestyle choices. Set aside 60% of your income for needs, ideally automating payments where possible for smoother management. Then allocate 20% to savings or investments, possibly using high-yield savings accounts. Finally, leave 20% for discretionary spending. Tracking these allocations over time is key, as it helps adjust and refine your approach based on what works for you.

Is the 60/20/20 rule suitable for everyone?

The 60/20/20 rule can be adapted to fit most lifestyles, but it might require tweaks depending on individual circumstances. For example, if you live in an area with high living costs, the percentage allocated to needs might need to be higher. Conversely, you might find yourself in a situation where you can reduce your needs or increase your savings rate due to financial stability. Ultimately, the essence of this rule is flexibility, and it’s about creating a budget that reflects your values and goals.

What if my expenses exceed 60% of my income?

If you find that your essential expenses exceed 60% of your income, it’s time to reassess and possibly prioritize your spending. Start by identifying areas where you can cut back on non-essential purchases. Consider negotiating bills, seeking out cheaper housing options, or even relocating. Additionally, look into increasing your income through side hustles or part-time jobs to help rebalance your budget within the 60/20/20 framework. The goal is to live within your means while still being able to save and enjoy your life.

Can I adjust the percentages among the categories?

Absolutely! The beauty of the 60/20/20 rule is its inherent flexibility. If you have specific financial goals, you can adjust the percentages accordingly. For instance, if you’re prioritizing savings for a large purchase, you might allocate 50% to needs, 30% to savings, and 20% to wants temporarily. Just be sure that any adjustments still reflect your values and overall financial health. The key is finding a balance that works for you and evolves as your needs change over time.

How do I track my expenses under this rule?

Tracking your expenses can be effortless with modern financial tools. You can use budgeting apps that automatically categorize transactions, making it simple to see where your money goes. Alternatively, a simple spreadsheet can work wonders: list out income and expenses, and categorize them according to the 60/20/20 rule. Regularly reviewing these figures—especially at the end of each month—will give you a clearer picture of your spending habits, helping you make informed decisions going forward.

What are the potential downsides of the 60/20/20 rule?

While the 60/20/20 rule offers a structured financial approach, it might not consider fluctuations in income, unexpected expenses, or varying priorities among individuals. It can also become challenging if economic conditions change, such as a recession or significant life changes like a job loss. Additionally, for those with significant debts, allocating only 20% for savings might not seem sufficient. Thus, it’s essential to approach this rule with a mindset willing to adapt and modify it based on your unique situation and objectives.