What is the 75 15 10 rule? If you’ve found yourself navigating the often complex landscape of personal finance, investment strategies, or budgeting, you’ve likely stumbled upon this intriguing rule. It’s a guideline that simplifies how we can allocate our income in a way that maximizes our financial well-being. By breaking down our earnings into manageable sections, the 75 15 10 rule serves as a compass, guiding us toward smart financial choices.

Understanding this rule can be a game-changer, especially for those who might feel overwhelmed by the intricacies of financial planning. Personal finance isn’t merely about managing numbers; it’s about fostering a mindset that helps us achieve our goals without unnecessary stress. This rule encapsulates that ethos, reminding us that financial serenity is achievable through balanced resource allocation.

But what makes the 75 15 10 rule particularly relevant in today’s financial climate? As living costs rise and financial literacy becomes more crucial, this straightforward approach serves both novices and experts alike. Whether you’re starting your first job, planning for retirement, or simply trying to make your money work harder, understanding this rule could significantly impact your financial trajectory.

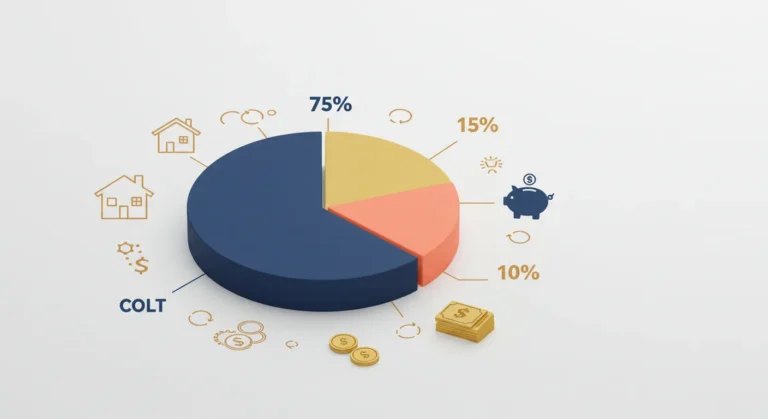

In a nutshell, the 75 15 10 rule breaks down your income into three categories: 75% for living expenses, 15% for savings, and 10% for investments. By adhering to this structure, you can maintain a grounded lifestyle while securing your financial future. So, let’s dive deeper into the dynamics of this rule and how you can effectively implement it in your life.

Understanding the Components of the 75 15 10 Rule

To fully appreciate the 75 15 10 rule, it’s essential to dissect each of its components. By understanding how to allocate your income effectively, you can set yourself on a path towards financial stability and growth.

The 75%: Living Expenses

The largest chunk of your income, 75%, is designated for your living expenses. This encompasses everything from your rent or mortgage to groceries, transportation, and healthcare costs. The goal here is to maintain a comfortable standard of living without overspending.

- Housing Costs: Ensure that your housing expenses don’t exceed 30% of your income. This benchmark helps you avoid financial strain.

- Essential Bills: Include all necessary utilities such as electricity, water, and internet in this category.

- Groceries & Transport: Budget for food and commuting costs, enabling you to live without feeling deprived.

Balancing Needs and Wants

Life is about balance, and your living expenses need to reflect that. While it’s easy to allocate funds for every desire, it’s crucial to differentiate between needs and wants. Prioritizing essential expenses first sets the stage for healthy financial habits.

The 15%: Savings for the Future

Next, we turn to the critical component of savings. By dedicating 15% of your income to savings, you’re building a safety net that can act as a financial buffer in times of need. This can mean the difference between financial anxiety and peace of mind.

Emergency Fund Essentials

All savings aren’t created equal. Start by establishing an emergency fund that covers 3-6 months’ worth of living expenses. This fund is essential for unexpected expenses, such as medical bills or home repairs, ensuring you don’t dip into debt.

Short-Term and Long-Term Goals

Once your emergency fund is established, consider your financial goals. Are you saving for a vacation, a new car, or perhaps a down payment on a house? Allocate these savings separately to help visualize your progress.

The 10%: Investing Wisely

The final piece of the pie is where the real magic happens: investments. By committing 10% of your income to investments, you’re positioning yourself for wealth accumulation over time. This is where your money has the potential to grow and multiply.

Diversifying Your Portfolio

Investing is not just about picking stocks; it’s about diversifying your investments to reduce risk. Consider allocating your investment funds across various assets, such as:

- Stocks: A traditional choice that can offer growth.

- Bonds: Typically safer and can provide steady income.

- Real Estate: A tangible investment that can yield returns.

Retirement Accounts: Plan Ahead

Contributing to retirement accounts such as 401(k)s or IRAs can also count towards your investment percentage. These accounts often have tax advantages that can enhance your overall financial strategy.

Implementing the 75 15 10 Rule

The thought of changing how you manage your money can be daunting, but implementing the 75 15 10 rule can be seamless with the right strategy. Consider these steps for effective implementation:

Track Your Spending

Start by analyzing your current spending habits. Use budgeting apps or simple spreadsheets to chart out where your money goes each month. This will provide a clear picture of your finances.

Adjust Wisely

If you’re currently spending more than 75% of your income on living expenses, take a good look at your discretionary spending. Identify areas where you can cut back and reallocate those funds into savings and investments.

Real-Life Scenario: Applying the Rule

Let’s put this in context with a fictional character named Sarah. Sarah is a 28-year-old marketing professional earning $4,000 a month. Using the 75 15 10 rule, she allocates her income like so:

- Living Expenses (75%): $3,000 for rent, utilities, groceries, and transportation.

- Savings (15%): $600 for her emergency fund and short-term goals.

- Investments (10%): $400 contributed to a diversified portfolio.

By adhering to this structure, Sarah finds herself not only able to cover her expenses but also building a secure financial future.

By adopting the 75 15 10 rule, you can give your financial life the structure it needs, allowing for growth, stability, and the freedom to pursue your passions. This rule encourages you to be proactive rather than reactive about your finances, ultimately leading to greater peace of mind. As you navigate your financial journey, remember that every small step you take today can have a monumental impact on your tomorrow.

Useful links

Conclusion

As we wrap up our exploration of the 75 15 10 rule, it’s clear that this framework is more than just numbers; it’s a mindset that can transform your approach to financial decisions. By dedicating 75% of your focus to long-term goals, you create a solid foundation for your future, setting yourself up for stability and financial independence. It’s like planting a seed today to reap a bountiful harvest down the line.

The 15% allocated for personal growth allows us to indulge in our passions and ongoing learning. This portion reminds us that life isn’t solely about saving and investing—it’s also about enjoying the journey. Whether it’s taking that art class you’ve always dreamed of or attending workshops to fuel your career, these investments in yourself can yield unexpected dividends in happiness and fulfillment.

Lastly, the 10% spent on fun brings balance. It’s a gentle nudge to live in the moment and celebrate achievements, which is vital for maintaining motivation. Money can often feel heavy or stressful, but with the 75 15 10 rule, you can embrace the joy of living today while strategically planning for tomorrow. So, as you consider this rule, remember it’s not about rigid adherence—it’s about finding a system that works for you and your unique lifestyle!

Frequently Asked Questions

What is the 75 15 10 rule?

The 75 15 10 rule is a financial guideline designed to help individuals allocate their resources effectively. Under this rule, 75% of your focus and resources should be devoted to long-term investments, such as retirement accounts, savings, and wealth-building strategies. The remaining 15% is for lifelong learning and personal development—this could be courses or experiences that enhance your skills and knowledge. Finally, the last 10% is for enjoying life through leisure activities and experiences that bring joy, ensuring a well-rounded approach to financial health and personal satisfaction.

How can I apply the 75 15 10 rule to my budget?

Applying the 75 15 10 rule to your budget involves breaking down your income or financial resources according to the three categories. Start by calculating 75% of your monthly income for long-term investments—this can include contributions to retirement accounts, savings plans, and investment portfolios. Next, allocate 15% for educational or personal development opportunities, making sure to explore costs related to classes or seminars. The remaining 10% should be set aside for enjoyment, from dining out to hobbies that make you happy. This structured yet flexible budgeting can significantly enhance both your financial security and quality of life.

Is the 75 15 10 rule flexible?

Absolutely! The 75 15 10 rule is designed to be adaptable. While the percentages serve as a great guideline, you should tailor them based on your personal financial situation, goals, and lifestyle. For instance, if you’re closer to retirement, you might lean more heavily on the long-term investments section. Conversely, if you’re young with less financial burden, you might want to increase your spending on personal development or leisure to explore different interests and growth opportunities. The key is to maintain a balance that feels right for you while keeping an eye on your overall financial health.

Does the 75 15 10 rule apply to everyone?

The 75 15 10 rule can be applied universally, but its effectiveness will vary based on individual circumstances. Factors like age, income level, life goals, and personal responsibilities play significant roles in how this framework can best serve you. For young professionals, the focus might lean more heavily toward personal growth and enjoyment, while families saving for children’s education might emphasize long-term saving. The beauty of the rule lies in its flexibility, allowing it to cater to a broad audience while still supporting customized financial planning.

What are some examples of long-term investments?

Long-term investments refer to financial commitments that typically span several years and are aimed at building wealth over time. Examples include retirement accounts such as IRAs or 401(k)s, which benefit from compounding interest. Real estate investments, whether through rental properties or REITs, also fall into this category. Additionally, investing in stocks or mutual funds with a long-term growth outlook are excellent ways to secure your financial future. These types of investments can result in substantial financial gains over time, providing stability for your retirement or other future financial goals.

Can the 75 15 10 rule help reduce financial stress?

Yes, the 75 15 10 rule can significantly reduce financial stress by providing a clear framework for managing your resources. When you have a plan that outlines where your money goes—emphasizing long-term security, personal growth, and leisure—it can alleviate the anxiety of financial uncertainty. Knowing that you’re investing in both your future and personal satisfaction creates a sense of control over your financial health. This dual-focus approach encourages mindful spending, which can enhance overall well-being and peace of mind.

What are the potential downsides to the 75 15 10 rule?

While the 75 15 10 rule offers a clear structure for financial planning, there are potential downsides to consider. For instance, strict adherence to the percentages may feel limiting, especially in times of unexpected expenses or financial emergencies. Furthermore, individuals with high debt might need to shift more resources toward debt repayment before focusing on investments or personal growth. The challenge lies in balancing the benefits of the rule while remaining responsive to changing financial situations or goals. Flexibility is crucial to making the most of this wealth-building framework!