What is the 50 30 20 rule for financial literacy? This straightforward budgeting guideline has gained traction as an effective framework for managing personal finances. It helps individuals allocate their income effectively, ensuring they cover their essential needs, desires, and savings. Whether you are a seasoned budgeter or just starting on your financial journey, understanding this rule can significantly enhance your financial health and security.

By defining a clear structure, the 50 30 20 rule empowers users to make informed decisions about their spending and savings. Notably, the rule provides a framework that is both flexible and easy to implement, catering to diverse financial situations and goals. This simplicity makes it a favorite among financial educators and individuals alike. In the subsequent sections, we will explore the intricacies of this budgeting rule, its advantages, and practical applications that can help you achieve financial literacy.

As we delve deeper into the 50 30 20 rule, we will examine how to categorize expenses, set realistic financial goals, and ultimately harness this rule to foster better financial habits. This article aims to provide a comprehensive understanding of the rule and its relevance in today’s financial landscape. So, let’s explore this essential budgeting tool together!

Let’s begin with understanding the core components of the 50 30 20 rule.

Understanding the Breakdown of the 50 30 20 Rule

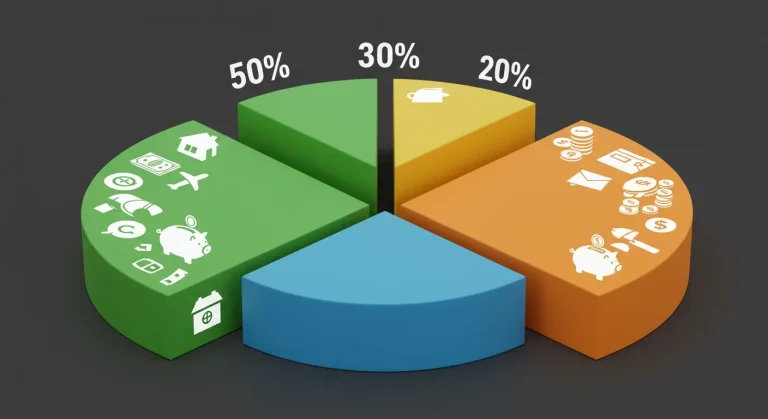

The 50 30 20 rule divides your after-tax income into three primary categories: needs, wants, and savings. This clear division helps individuals swiftly identify where their money goes each month.

Needs: 50% of Your Income

The first category encompasses all the essential expenses that you must cover to maintain your basic standard of living. This typically includes:

- Housing (rent or mortgage)

- Utilities (electricity, water, internet)

- Groceries

- Transportation (fuel, public transit)

- Health insurance and medical expenses

By allocating 50% of your income to needs, you ensure that your basic living requirements are met before spending on non-essentials.

Wants: 30% of Your Income

The next portion of the 50 30 20 rule pertains to your desires—those discretionary expenses that enhance your quality of life but aren’t strictly necessary. Common examples include:

- Dining out

- Entertainment (movies, concerts)

- Travel and vacations

- Hobbies and personal interests

By designating 30% of your income to wants, you can enjoy a fulfilling lifestyle while still adhering to your financial obligations.

Savings: 20% of Your Income

Finally, the rule allocates 20% of your income to savings and debt repayment. This vital segment ensures you are prioritizing your future financial security. Key considerations include:

- Building an emergency fund

- Retirement savings (401(k), IRA)

- Investments in stocks and mutual funds

- Paying off debt (credit cards, loans)

By following this guideline, you create a safety net and work towards your long-term financial goals.

Benefits of the 50 30 20 Rule

Embracing the 50 30 20 rule comes with numerous advantages, making it a compelling choice for financial management.

Clarity and Control

This rule provides a clear framework for individuals to understand their spending habits, bringing transparency to finances. With set percentages, it becomes easier to track expenses and adjust spending patterns accordingly.

Flexibility

Life circumstances can change, and the 50 30 20 rule adapts effortlessly to those changes. Whether you receive a raise, face unexpected expenses, or change your financial goals, you can adjust your budget while maintaining the same percentage allocations.

Encouragement of Savings

One of the most significant benefits is how it actively encourages saving. By designating a specific percentage for savings, individuals are more likely to cultivate a habit of setting aside funds for the future, laying the groundwork for financial stability.

Implementing the 50 30 20 Rule in Your Life

Now that we’ve discussed what the 50 30 20 rule is and its benefits, let’s explore how to implement it effectively in your personal financial practices.

Track Your Income and Expenses

Start by gathering information about your total after-tax income and make a comprehensive list of your monthly expenses. This record sets the baseline for your budget.

Adjusting Your Budget

After categorizing your expenses into needs, wants, and savings, assess if your current allocations align with the 50 30 20 percentages. If expenses in any category exceed the set limit, prioritize adjustments. This could involve reducing discretionary spending or finding cost-effective alternatives for needs.

Use Budgeting Tools

Leverage modern budgeting tools and apps that align with the 50 30 20 framework. These tools can provide valuable insights into your spending patterns, streamline tracking, and help you stay accountable.

Common Misconceptions About the 50 30 20 Rule

Despite its simplicity, several misconceptions surround the 50 30 20 rule that can hinder effective implementation.

One Size Fits All?

While the rule provides a solid foundation, personal finance is inherently unique. The percentages may need adjustments based on individual circumstances, such as high living costs or significant debts. Tailor the percentages to your needs without compromising financial stability.

Debt Repayment is Optional

Some individuals mistakenly view debt repayment as a secondary concern. However, incorporating debt repayment into the 20% savings category ensures you are diligently working towards financial freedom. Prioritize paying off high-interest debts first to minimize overall costs.

Tips for Mastering the 50 30 20 Rule

To successfully implement the 50 30 20 rule, consider these practical tips for financial mastery.

Regular Review and Adjustments

Set aside time each month to review your budget and spending. This practice allows for timely adjustments and helps keep financial goals at the forefront of your priorities.

Set Clear Financial Goals

Define specific short-term and long-term goals for savings. Whether it’s building an emergency fund or saving for a vacation, having concrete objectives can motivate you to stick to your budget.

Be Mindful of Lifestyle Inflation

As income increases, it’s easy to fall into the trap of lifestyle inflation—spending more as earnings rise. Counteract this by maintaining the 50 30 20 rule, adjusting your budget appropriately without compromising savings and essential expenses.

Useful links

Conclusion

In summary, the 50 30 20 rule offers a straightforward framework for managing personal finances effectively. By allocating 50% of your income to needs, 30% to wants, and 20% to savings or debt repayment, individuals can achieve a balanced financial life. This simple budgeting method not only promotes financial discipline but also encourages awareness about spending habits, fostering better decision-making in everyday life.

Implementing this rule can lead to significant long-term benefits. With the right mindset and adherence to the allocation percentages, individuals can prepare for unexpected expenses, build emergency funds, and save for future goals such as retirement or large purchases. Moreover, it empowers people to distinguish between essential needs and discretionary wants, reducing impulsive spending and boosting overall financial health.

Ultimately, the 50 30 20 rule serves as a valuable tool for anyone aiming to enhance their financial literacy. By understanding and applying this method, individuals can take control of their finances, setting themselves on the path to achieving both short-term stability and long-term wealth. With determination and commitment, anyone can adopt this framework and transform their financial future for the better.

Perguntas Frequentes

What is the purpose of the 50 30 20 rule?

The main purpose of the 50 30 20 rule is to provide a simple and effective budgeting framework that helps individuals manage their income responsibly. By categorizing expenses into needs, wants, and savings or debt repayment, this rule encourages financial discipline and awareness. It aids in achieving balance in spending, ensuring that essential living costs are covered while still allowing for enjoyment and long-term financial health through savings and debt reduction. Overall, it empowers users to take charge of their financial journey.

How do I classify my expenses under the 50 30 20 rule?

To effectively apply the 50 30 20 rule, begin by classifying your expenses into three categories. Needs encompass essential costs such as housing, utilities, food, transportation, and insurance—expenses necessary for basic living. Wants include non-essential items like dining out, entertainment, and luxury goods—things that enhance your quality of life but are not mandatory. Lastly, savings or debt repayment should focus on building an emergency fund, retirement savings, or paying down existing debts, ensuring that you are preparing for future financial stability.

Can I adjust the percentages of the 50 30 20 rule?

Yes, you can adjust the percentages of the 50 30 20 rule to better fit your financial situation. While the standard guideline is beneficial as a starting point, you may find that your circumstances require more flexibility. For instance, if you have high monthly debt payments, you might allocate 30% to savings and debt repayment instead of following the strict 20%. It’s important to personalize the rule according to your lifestyle, financial goals, and obligations, while still striving for a balanced approach to managing your finances.

Is the 50 30 20 rule suitable for everyone?

While the 50 30 20 rule is a flexible and straightforward framework, its effectiveness may vary among individuals based on their unique financial situations. Factors such as income level, living expenses, and personal financial goals will influence how well this budgeting method works for someone. It’s crucial for individuals with complex financial needs, such as high debts or specific investment goals, to consider additional strategies or consult a financial advisor to develop a more tailored plan that meets their requirements.

How can I track my spending effectively with this rule?

Tracking your spending effectively involves using budgeting tools and techniques that align with the 50 30 20 rule. You can utilize budgeting apps, spreadsheets, or even pen and paper to record your expenses. Regularly review your spending data to ensure it aligns with the allocated percentages. Keeping receipts, setting monthly financial reviews, and categorizing expenses help maintain awareness. The more diligent you are in monitoring your spending, the easier it will be to stay on track and make necessary adjustments to adhere to the rule.

What should I do if my needs exceed 50% of my income?

If your needs exceed 50% of your income, it’s important to reassess your budget and identify areas for potential savings. Begin by reviewing your needs to see if any expenses can be reduced, such as relocating to a more affordable housing option or switching to a less expensive grocery store. If these adjustments are not feasible, consider reevaluating your wants or increasing your income through side jobs or additional work. Prioritizing essential expenses while being mindful of discretionary spending can help realign your finances with the 50 30 20 rule.

Can I use the 50 30 20 rule for irregular income?

Yes, the 50 30 20 rule can be adapted for individuals with irregular income, such as freelancers or commission-based workers. Start by calculating your average monthly income over a set period, typically six months to a year, to establish a baseline. Once you have an estimated average, apply the 50 30 20 percentages to create your budget. Additionally, it is wise to prioritize saving during months of higher income to create a cushion for leaner times, ensuring your financial stability despite income fluctuations.