What percentage of Americans are financially illiterate? This question is more than just a statistic; it’s a reflection of our nation’s understanding of finance, a crucial aspect of everyday life. With financial literacy shaping our ability to manage money, make investments, and plan for the future, it’s essential to explore not only the numbers but the underlying implications as well. As we delve into the nuances of financial literacy in the U.S., we uncover a landscape that is complex and ripe with challenges.

Understanding financial literacy can empower individuals to navigate the vast terrain of personal finance, determining everything from day-to-day expenses to long-term wealth accumulation. Unfortunately, many Americans find themselves standing on shaky ground in this arena. It’s vital for us to grasp the significance of these statistics, as they can inform educational policies and individual actions aimed at improving financial knowledge across the board.

So, just how many Americans are struggling with financial literacy? Statistics reveal sobering trends that underscore a broader issue affecting all levels of society. As educators, policymakers, and citizens, we have a collective responsibility to address this skill gap to ensure a more financially sound future for everyone.

Throughout this article, we will analyze critical facets of financial literacy in America, exploring relevant data, suggesting actionable solutions, and considering what we can do collectively to improve this pressing issue. Let’s embark on this journey together and uncover the depths of financial literacy in our country.

The Stats Behind Financial Literacy in America

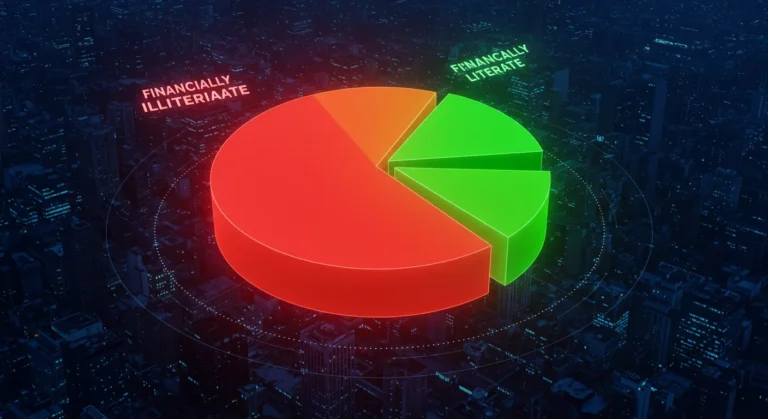

Recent studies indicate that approximately 66% of Americans are financially illiterate, struggling to manage basic financial tasks like budgeting, saving, and investing. This statistic resonates alarmingly as we take a closer look at the implications of such a deficit. Understanding basic financial concepts does not only prevent personal financial crises but also strengthens the economy as a whole.

The Definitive Survey Breakdown

A comprehensive survey conducted by the National Endowment for Financial Education (NEFE) sheds light on the granular elements of this issue. The survey highlights that a significant number of adults lack understanding in areas such as:

- Interest rates and their impact on debt management

- Investment principles and choosing appropriate investment vehicles

- The workings of credit scores and their ramifications

Each of these areas is foundational to making informed financial decisions, suggesting that initiatives aimed at educating Americans in these specific aspects may yield beneficial results.

The Demographics: Who Is Affected?

Financial literacy doesn’t discriminate on the surface; however, when we peel back the layers, we see disparities across various demographics. Age, education level, and income influence the percentage of financial literacy among different groups.

Age and Education

Younger individuals, particularly Millennials and Gen Z, often report feeling less financially literate than older generations. This disconnect stems in part from the evolving nature of the economy and financial products available today. Meanwhile, individuals who have pursued higher education tend to score higher on financial literacy assessments. However, this doesn’t mean that everyone with a college degree is financially savvy.

Income Inequality

Moreover, the divide widens when we consider income levels. Lower-income populations frequently lack access to financial education resources and tools. They may not have had exposure to personal finance courses in school or experience managing finances in a live setting, paving the way for ongoing financial struggle.

The Role of Financial Education Programs

To combat financial illiteracy, several organizations and educational institutions are taking proactive steps to enhance financial literacy. Programs aimed at both children and adults are emerging, focusing on various aspects of personal finance.

School Curriculums

Integrating financial education into school curriculums has proven to be a vital method. States like Virginia and Utah have made financial literacy a requirement for high school graduation, setting a precedent for others to follow. Teaching students how to manage money from a young age can foster habits that last a lifetime.

Community Outreach

In addition to schools, community organizations and nonprofit groups frequently host workshops and seminars geared towards practical financial skills, such as:

- Budget creation and management

- Debt reduction strategies

- Investment basics and retirement planning

These efforts aim to create grassroots movements towards better financial well-being and are often tailored to meet specific community needs.

The Emotional Impact of Financial Literacy

Beyond just numbers and figures, the emotional implications of financial illiteracy are profound. Many individuals experience anxiety related to personal finances, leading to stress that permeates their personal and professional lives. This is not just a subjective observation; studies reveal that financial strain can adversely affect mental health.

Life in Debt

A hypothetical scenario illustrates this point: imagine a young professional, Jess, who excels in her job yet feels overwhelmed by student loans and credit card debt. Her financial illiteracy leads her to make missteps, like only paying the minimum on her credit cards. Consequently, she feels trapped under a weighty financial burden, affecting her job performance and personal relationships.

The Ripple Effect

Jess’s experience is not uncommon. When individuals like her struggle with financial concepts, the effects ripple across their communities. Parents who lack financial literacy often pass these challenges onto their children, creating a cycle that’s hard to break.

Practical Steps to Improve Financial Literacy

Recognizing the issue is merely the first step; action is what truly counts. Here are a few straightforward, practical steps you can take or encourage others to adopt to improve financial literacy.

Start with Resources

Several online platforms, such as Khan Academy and Coursera, offer free courses on financial literacy that cater to different skill levels and topics. Taking modest steps towards educating ourselves is paramount.

Engage in Conversations

Initiate discussions about finances with family and friends. Share knowledge, ask questions, and learn together. You’d be surprised how discussing personal finance can demystify the subject and make it more approachable.

Utilize Financial Planning Tools

Leverage budgeting apps like Mint or YNAB (You Need A Budget) to track spending and savings. These tools simplify finance management, making financially responsible choices far less daunting.

Useful links

Conclusion

As we step back to examine the concerning landscape of financial literacy in America, the health of our collective economic understanding is a mixed bag. A significant percentage of Americans remain financially illiterate, often grappling with concepts foundational to accumulating wealth and financial well-being. This discomfort with money matters isn’t just a statistic; it ripples through families and communities, influencing decisions about education, health, and retirement. The struggles of many to grasp the nuances of personal finance underscore a crisis that goes beyond individual mismanagement and hints at systemic failures in our education and societal priorities.

Imagine a single mother named Sarah, who juggles multiple jobs to provide for her children. She’s hardworking and dedicated but feels completely overwhelmed when faced with choices about a 401(k) or how to apply for credit. It’s easy to see how someone in her position may inadvertently fall prey to bad financial decisions simply due to a lack of understanding. Sarah’s experience is not unique; it reflects a common narrative that many face, one marked by lack of access to essential resources and education. Thus, addressing this financial literacy gap is vital not only for individual empowerment but also for fostering a more robust economy.

In conclusion, tackling financial illiteracy demands a collective response. We need to champion education initiatives that empower individuals of all ages and backgrounds. Whether it’s through community workshops, school programs, or online courses, we have the opportunity to inspire change. By equipping people like Sarah with the necessary tools and knowledge, we can transform apprehension into confidence, enabling a brighter financial future for all. So let’s advocate for and participate in efforts to improve financial literacy—because every person deserves a fair shot at understanding and enhancing their financial well-being.

Frequently Asked Questions

What is the percentage of Americans who are financially illiterate?

Approximately 60% of Americans demonstrate some level of financial illiteracy, as indicated by surveys and research studies. This significant percentage represents individuals who struggle with basic financial concepts, such as budgeting, interest rates, and saving for retirement. These gaps in understanding can lead to poor financial decisions, impacting everything from consumer credit to investing. Moreover, this lack of financial knowledge often perpetuates a cycle of disadvantage, highlighting the need for more robust financial education programs across the nation.

Why is financial literacy important?

Financial literacy is crucial because it empowers individuals to make informed and effective decisions regarding their financial resources. Without a solid understanding of financial principles, people may face challenges in budgeting, saving, and investing. This can lead to struggles such as excessive debt, poor credit scores, or inadequate savings for emergencies and retirement. Essentially, financial literacy is not just about understanding money—it’s about fostering independence, security, and the capability to navigate the complex economic landscape more confidently.

How does financial illiteracy affect the economy?

Financial illiteracy can have far-reaching effects on the economy. With a significant portion of the population lacking essential financial understanding, we see increased rates of debt, lower savings rates, and decreased investment in education or housing. This can hinder economic growth, as fewer individuals are able to participate actively and responsibly in financial markets. Furthermore, the economy relies on consumers making informed choices that fuel business growth and innovation; a financially illiterate populace can stifle that progress, affecting jobs and community development as well.

What are the signs of financial illiteracy?

Signs of financial illiteracy can often be subtle but revealing. Individuals may struggle to create and stick to a budget, fail to understand credit reports or loan agreements, or be unaware of the importance of savings strategies. They might also engage in impulsive spending without considering long-term consequences. If someone avoids conversations about anything finance-related, or feels lost when faced with financial decisions, these can all indicate a gap in financial understanding that needs to be addressed.

How can one improve financial literacy?

Improving financial literacy involves several proactive steps. Reading books and articles on personal finance can provide a foundation. Additionally, online courses or workshops offered by community colleges and financial organizations can yield valuable insights. Engaging with financial advisors, either formally or informally, can also clarify complex concepts. Ultimately, the key is a commitment to learning and seeking resources, so individuals stay informed and confident in their financial decisions.

What role do schools play in promoting financial literacy?

Schools play a vital role in fostering financial literacy by integrating personal finance education into their curricula. When students learn about budgeting, credit management, and investments before graduating, they build essential skills for their futures. Some states have started requiring financial literacy courses, and that trend must continue to prepare students for real-world financial responsibilities. Engaging students early on in financial education lays a foundation for healthier financial habits throughout their lives.

What impact does technology have on financial literacy?

Technology significantly influences financial literacy by providing accessible resources and tools. With a wealth of mobile apps, online courses, and websites dedicated to personal finance, individuals can learn at their own pace. These digital platforms often provide interactive experiences such as budgeting calculators or investment simulators, making complex financial concepts more understandable. However, technology can also be a double-edged sword; it’s essential to ensure individuals are discerning about the sources they trust and the advice they follow.